Budgeting for Families sets the stage for financial success, offering a roadmap for families to navigate their finances with confidence and ease. From creating a budget to setting financial goals, this guide covers it all.

Dive into the world of family budgeting and discover the keys to securing a stable financial future for you and your loved ones.

Importance of Budgeting for Families

Budgeting is crucial for families as it helps in managing finances effectively, ensuring that every dollar is allocated wisely to meet the family’s needs and goals. Without a budget, families may overspend, accumulate debt, and struggle to cover essential expenses.

Benefits of Having a Budget

- Helps in tracking income and expenses to avoid overspending.

- Allows families to prioritize financial goals such as saving for emergencies, education, or retirement.

- Reduces financial stress by providing a clear roadmap for managing money.

- Encourages communication and teamwork within the family when making financial decisions.

Real-life Examples of Budgeting Impact

- A family creates a budget and starts saving for a down payment on a house, eventually achieving their dream of homeownership.

- By budgeting for groceries and meal planning, a family reduces food waste and saves money on unnecessary purchases.

- Through budgeting, a family pays off their credit card debt and starts building a strong financial foundation for the future.

Creating a Family Budget: Budgeting For Families

Creating a family budget is crucial for managing finances effectively and ensuring that all expenses are accounted for. By following a few simple steps, you can create a budget that works for your family’s needs.

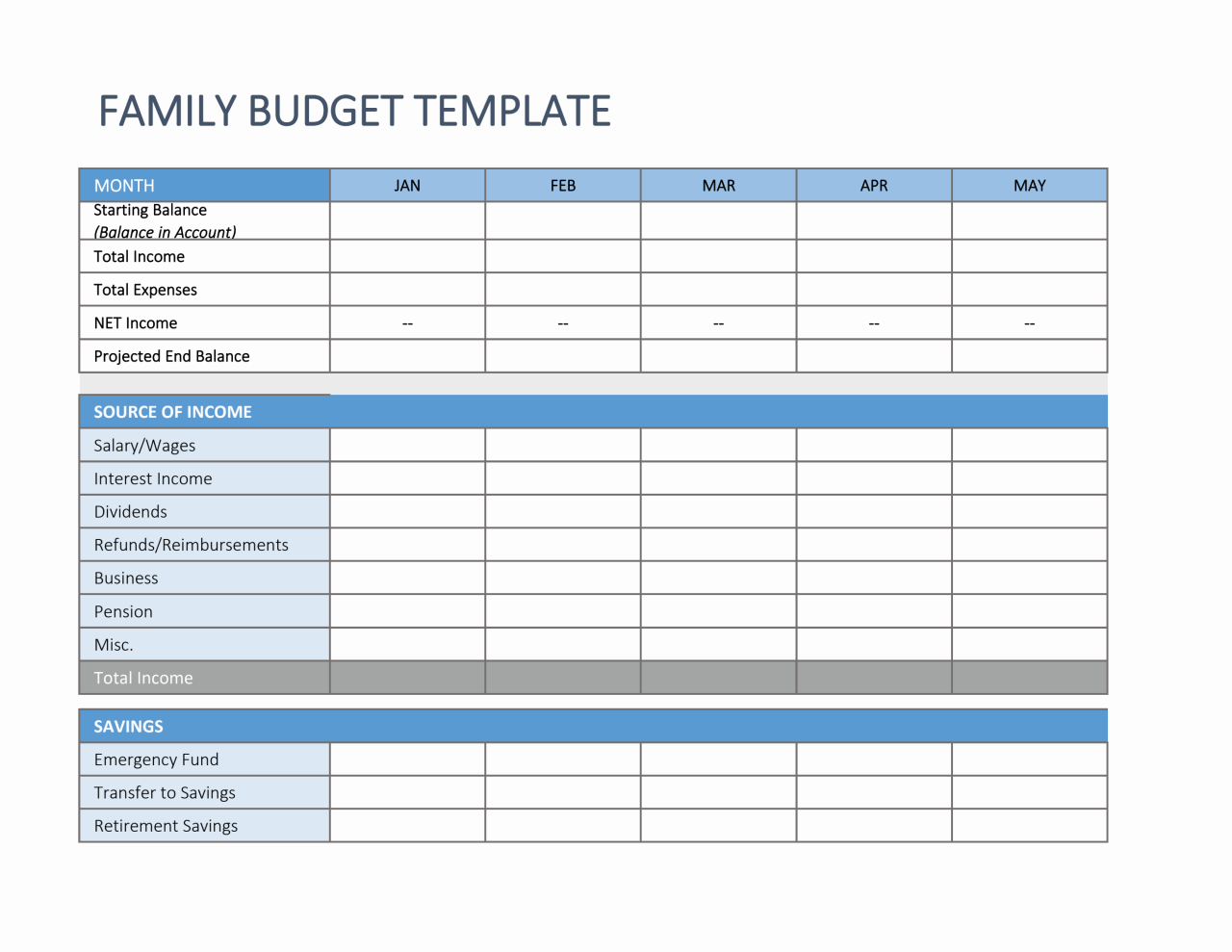

Step-by-Step Guide to Creating a Family Budget

- List all sources of income: Start by determining all sources of income for your family, including salaries, bonuses, and any other sources of money.

- Track your expenses: Keep a record of all expenses, from groceries to utility bills, to understand where your money is going.

- Set financial goals: Determine short-term and long-term financial goals for your family, such as saving for a vacation or paying off debt.

- Create a budget: Allocate your income to different expense categories, ensuring that you prioritize essential expenses like rent and groceries.

- Monitor and adjust: Regularly review your budget to see if you are staying on track and make adjustments as needed.

Different Budgeting Methods for Families

- Traditional budgeting: Involves manually tracking income and expenses using pen and paper or a spreadsheet.

- Envelope system: Allocate cash to different envelopes for specific expenses, helping you stay within budget.

- Zero-based budgeting: Assign every dollar of income to a specific expense category, ensuring that no money goes unaccounted for.

Manual Budgeting vs. Budgeting Apps or Software

- Manual budgeting: Requires discipline and time to track expenses and income, but offers a hands-on approach to managing finances.

- Budgeting apps or software: Provide convenience and automation in tracking expenses and income, offering visual representations of your financial health.

- Comparison: Manual budgeting allows for a deeper understanding of your finances but can be time-consuming, while budgeting apps offer efficiency and ease of use.

Setting Financial Goals for Families

Setting financial goals within a family budget is crucial for ensuring financial stability and growth. By establishing clear objectives, families can prioritize their spending, save effectively, and work towards achieving their long-term aspirations.

Short-term Financial Goals

- Building an emergency fund to cover unexpected expenses.

- Reducing credit card debt to improve financial health.

- Setting a monthly savings target for specific goals like a family vacation.

Long-term Financial Goals

- Saving for children’s education to alleviate future financial burdens.

- Investing in retirement funds to secure financial stability in old age.

- Purchasing a home to provide long-term security for the family.

Importance of Setting Financial Goals

Setting financial goals helps families prioritize their spending, save consistently, and work towards achieving their dreams. By having clear objectives, families can track their progress, stay motivated, and make informed financial decisions. Ultimately, setting financial goals enables families to achieve financial stability and growth, ensuring a secure future for themselves and their loved ones.

Teaching Kids about Budgeting

Teaching kids about budgeting is an essential life skill that can set them up for financial success in the future. Instilling good financial habits in children from a young age can help them make wise decisions with money as they grow older.

Strategies to Educate Children about Budgeting and Money Management, Budgeting for Families

- Start with simple concepts like saving, spending, and sharing.

- Use real-life examples to explain the value of money and the importance of budgeting.

- Involve children in family budget discussions to help them understand how money is managed.

- Encourage kids to set savings goals for things they want to buy.

Importance of Instilling Good Financial Habits in Children

- Teaching kids about budgeting early on can help them develop responsible money habits.

- Children who learn about budgeting are more likely to make informed financial decisions as adults.

- Instilling good financial habits can lead to greater financial security and independence in the future.

Age-Appropriate Ways to Involve Children in Family Budgeting Discussions

- For young children, use piggy banks or clear jars to visually represent saving, spending, and sharing money.

- As kids get older, consider giving them a small allowance to manage and budget on their own.

- Discuss family financial goals and involve children in decision-making processes, such as choosing between spending options.

- Encourage older children to track their expenses and savings to understand the value of budgeting.

Managing Expenses within a Family Budget

When it comes to managing expenses within a family budget, it is crucial to identify common expenses that families should include in their budget. By understanding these expenses, families can develop strategies for cutting costs, saving money, and handling unexpected expenses or financial emergencies effectively.

Common Expenses to Include in a Family Budget

- Housing Costs: This includes rent or mortgage payments, property taxes, homeowners’ insurance, and utilities such as electricity, water, and gas.

- Transportation Expenses: Budget for car payments, insurance, gas, maintenance, and public transportation costs.

- Food and Groceries: Allocate a portion of the budget for groceries, dining out, and other food-related expenses.

- Healthcare Costs: Factor in health insurance premiums, co-pays, prescription medications, and medical supplies.

- Childcare and Education: Include costs for daycare, school tuition, supplies, and extracurricular activities.

Strategies for Cutting Costs and Saving Money

- Create a detailed budget and track expenses to identify areas where you can cut back.

- Look for coupons, deals, and discounts when shopping for groceries, clothes, or other necessities.

- Consider meal planning and cooking at home to save money on dining out expenses.

- Shop around for better deals on services like insurance, cable, internet, or phone plans.

- Set savings goals and automate transfers to a savings account to build an emergency fund.

Handling Unexpected Expenses or Financial Emergencies

- Build an emergency fund to cover unexpected expenses like car repairs, medical bills, or home maintenance.

- Consider getting insurance coverage for major expenses like health emergencies or property damage.

- Explore options for short-term loans or lines of credit in case of financial emergencies.

- Adjust your budget as needed to accommodate unexpected expenses without derailing your financial goals.